Bridging the Digital Divide: Infrastructure, Human Capital, and the Future of Africa

1. The African Digital Renaissance: An Era of Convergence

Sub-Saharan Africa (SSA) has entered a pivotal era defined by the convergence of a "youth bulge"—with over 50% of the population under age 20—and a "bandwidth explosion." This is not merely a technical milestone but a socio-economic imperative. The synergy between physical infrastructure and human readiness is the primary driver of future regional stability; without the latter, the former remains an expensive, underutilized asset. To absorb the millions of youth entering the labor market, we must move beyond the "landing station" mentality.

From a strategic perspective, the focus has shifted to the "middle-mile." Nigeria’s $2 billion project to deploy 90,000 km of fiber-optic cable, supported by the World Bank, serves as the blueprint for reaching schools, hospitals, and inland enterprises. Similarly, the "digital corridor" across the continent’s midsection is dismantling the geographic isolation of landlocked nations. These terrestrial backbones are transforming fragmented connectivity into a unified digital market, bringing immense capacity that serves as the foundation for a high-output digital economy.

2. Mapping the New Frontier: Subsea and Terrestrial Infrastructure (2024–2027)

The transition from isolated, fragmented connectivity to a resilient "mesh" network is fundamentally altering the continent’s economic potential. By creating a redundant web of subsea and terrestrial routes, SSA is mitigating the risks of single-point failures and lowering the cost of participation in the global digital economy. For a telecommunications analyst, the focus is on how this volume drives down retail prices, which are projected to drop by 20–30% in coastal nations as these projects mature.

The scale of this expansion is captured by the fact that international bandwidth capacity is forecast to be 500% higher by the end of 2026 than it was in 2021. Average monthly data usage is already surging, rising from 1.5 GB in 2021 to 6.2 GB in early 2026.

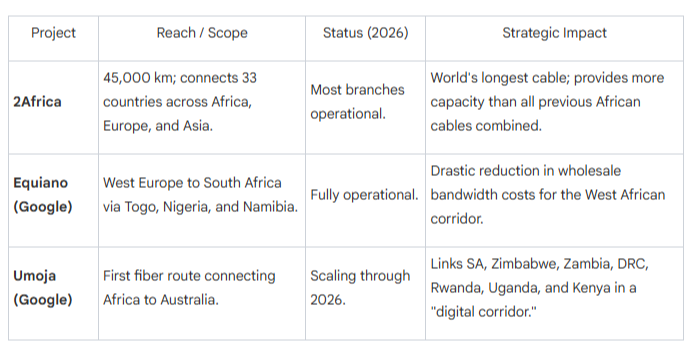

List of major internet infrastructure development projects.

While the "pipes" are built, the sheer scale of the 15–20 billion annual investment creates a significant Return-on-Investment (ROI) risk if the "Usage Gap" is not closed. Infrastructure alone cannot generate value if the population lacks the means to utilize it.

3. The Connectivity Paradox: Analyzing the Usage Gap

Despite signal coverage reaching nearly 85% of the population, a staggering 60–64% live within network range but remain offline. This "Usage Gap" proves that infrastructure is not a panacea. From a strategist's view, this gap represents trapped economic potential. The barriers are not merely lack of interest, but a systemic "Hardware Hurdle" compounded by energy instability.

The exclusionary nature of the digital economy is highlighted by two critical factors:

The Hardware Hurdle: While SSA is a "Mobile-First" culture, professional and educational production requires laptops. However, 67% of citizens lack household computer access, and only 18% personally own one. This is exacerbated by unreliable power grids and frequent "load shedding," which makes maintaining hardware nearly impossible for many.

The Affordability Crisis: For the poorest 20% of the population, an entry-level smartphone costs 99% of a month’s income. Even for the average woman in SSA, a smartphone represents 24% of monthly income.

Furthermore, the "Gender Gap"—where women are 29% less likely than men to use mobile internet—is not just a social issue; it is a GDP growth inhibitor. Closing this gap is a strategic necessity, as women are primary actors in the informal trade and agriculture sectors. These digital barriers correlate directly with the region’s persistent labor market struggles.

4. Labor Dynamics: The NEET Crisis and the Youth Bulge

The demographic reality of SSA is a double-edged sword. While the youth bulge offers a vast labor supply, the "NEET" (Not in Employment, Education, or Training) rate of 22% poses a risk to regional stability. As of 2026, unemployment figures continue to mask the reality of "vulnerable employment"—informal work lacking social protection.

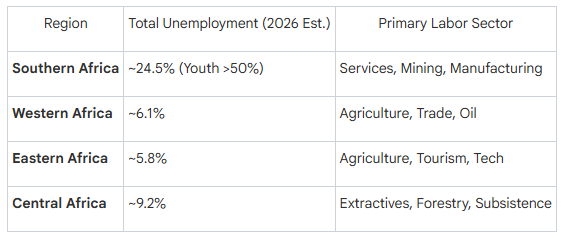

Data of unemployment per general region. Data is based on registered persons

Unemployment remains stubborn despite tech growth (which now accounts for 7.7% of Africa's GDP) because of a critical mismatch: the speed of infrastructure deployment is outstripping the speed of curriculum reform. The "New Digital Economy" requires skills that are not being taught at scale, leaving millions of youth with 4G access but 2G skillsets. Bridging this gap requires a pivot toward digital-first education and vocational training.

5. Education and TVET: Catalyzing Human Capital

Strategic transformation requires shifting from physical classrooms to "anywhere, anytime" learning. This is essential in a region where physical textbooks are absent in half of all classrooms. Digital platforms are not just supplements; they are the primary delivery mechanism for a mobile-first population.

Proof-of-concept models are already demonstrating systemic efficiency:

The Wikipedia Effect: In Malawi, students with mobile access to information saw significant improvements in English exam results, effectively narrowing the gap between high and low-performing cohorts.

Systemic Mapping: Ghana and Tanzania now use Geographic Information Systems (GIS) to map schools and track student achievement, ensuring data-driven resource allocation.

Open Educational Resources (OER): Platforms like Siyavula in South Africa provide digitized curricula, eliminating the high cost of physical books.

Vocational transformation is also occurring through Technical and Vocational Education and Training (TVET). Modular micro-credentials in coding and data analysis allow youth to enter the "iWorker" economy. Through "Impact Sourcing," youth in both urban and rural areas can engage in global BPO and data labeling tasks, provided they have the hardware and connectivity to compete.

6. Conclusion: A Strategic Roadmap for Affordable Empowerment

Africa’s digital renaissance is no longer a prospect; it is a multi-billion-dollar reality. However, the 15–20 billion in annual infrastructure investment will only yield its full socio-economic return if it is matched by aggressive investment in digital literacy and hardware affordability.

We must adopt a prescriptive approach:

Policy-Driven Subsidies: Governments must address the Hardware Hurdle by reducing import duties on entry-level smartphones and laptops and incentivizing off-grid solar charging solutions for rural learners.

Modular Training Platforms: Digital-first, modular certifications must become the standard for the NEET population, allowing for rapid upskilling that bypasses slow-moving traditional educational cycles.

The goal of every dollar invested in subsea cables must be the creation of an inclusive ecosystem. Training and digital tools must be viewed as a fundamental right, not a luxury. Only by lowering the cost of entry and closing the gender gap can we ensure that Africa's youthful workforce is prepared to lead the digital renaissance rather than being left behind by it.